What is systemic investing, and how is it different from other forms of purpose-driven finance?

This is the question we are asked most often here at the Transcap Initiative.

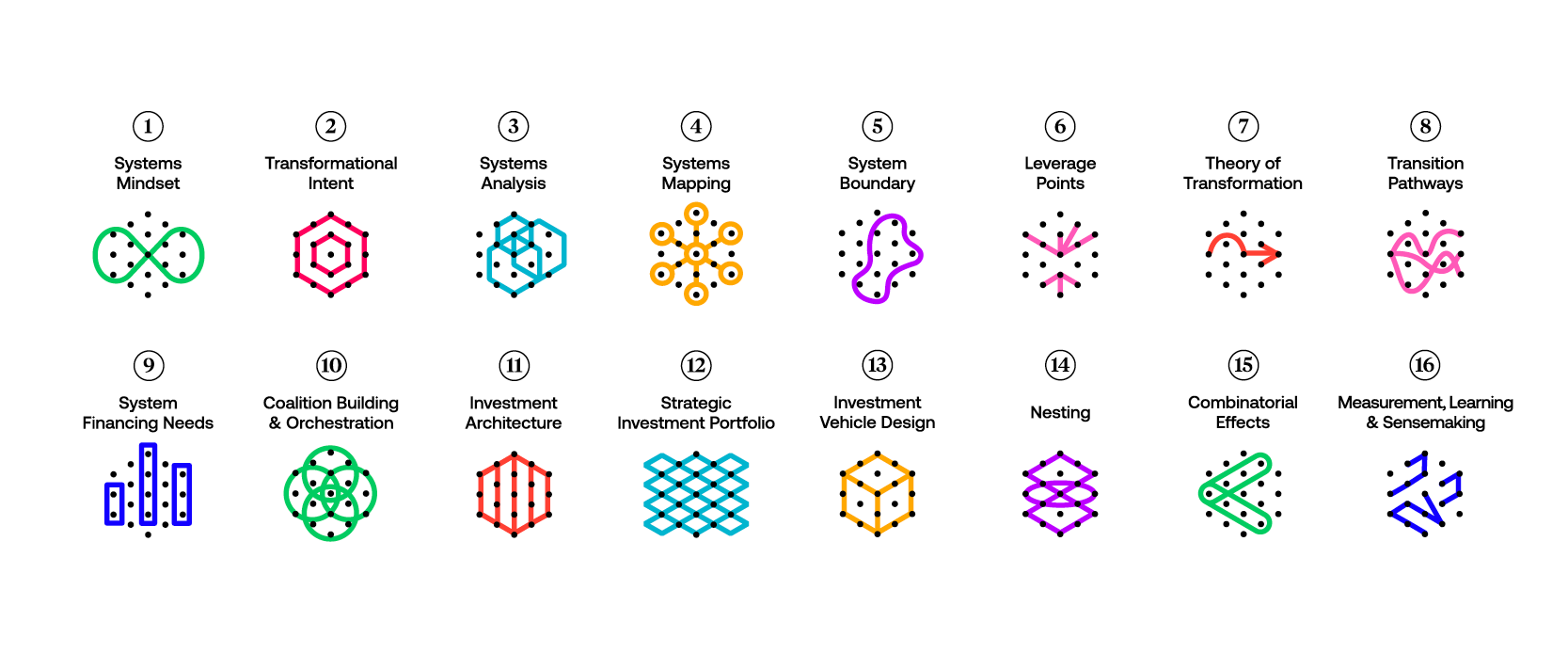

Today we’re publishing the first version of the Definition and hallmarks of systemic investing, a key document that defines and describes what we mean by systemic investing and what it could look like in practice. The hallmarks break down a very big idea into more manageable pieces and give us language for developing the field.

By defining and describing systemic investing, some of the differences to more established forms of purpose-driven finance—including impact investing and ESG investing—will become apparent. However, this document doesn’t compare and contrast systemic investing to those other approaches in a systematic way. While developing such a taxonomy is part of our research agenda, we must first establish what systemic investing is, which is what this document does.

The hallmarks are the result of extensive conceptual work—the thinking through by the TCI team as well as countless conversations and interactions with pioneers in the “systems + investing” ecosystem, whose inspiring work helps us to refine our own thinking. Those of you who have been on the journey with us for a while will recognise many of the hallmarks from our earlier “key concepts” work. The hallmarks update and replace these key concepts.

Systemic investing is a nascent field. The hallmarks are a snapshot of our thinking and we want to develop and evolve this document over time in collaboration with our community. We invite you to critique this work.

If you have insight to share, please take part in the consultation via the googleform.