Who We Are

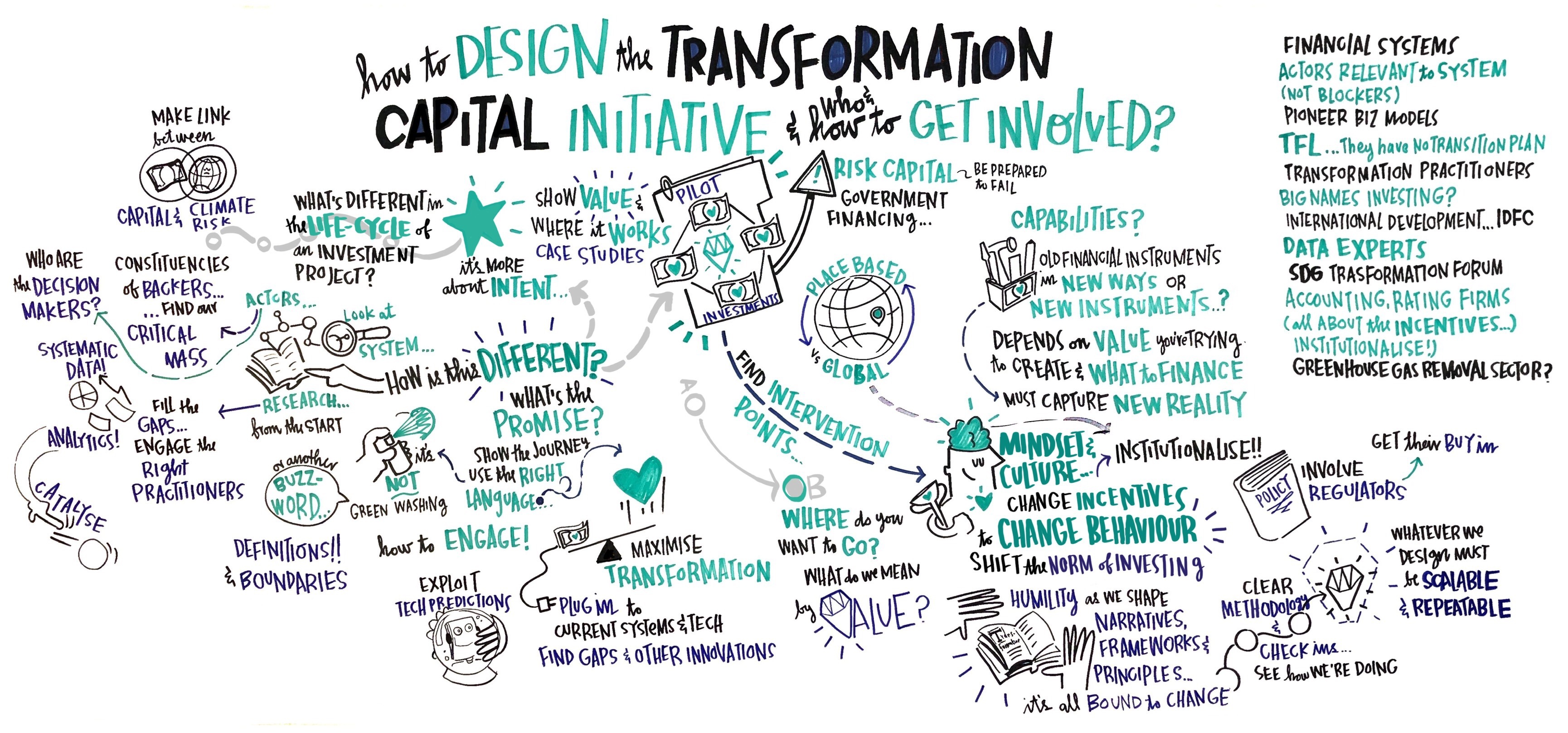

The TransCap Initiative is a think-and-do-tank operating at the nexus of real-economy systems change, sustainability, and finance. We operate as a multi-stakeholder alliance coordinated by a backbone team and comprised of wealth owners, innovation leaders, system thinkers, research institutes, and financial intermediaries. Our community is open to anyone committed to our cause and values.

Why We Exist

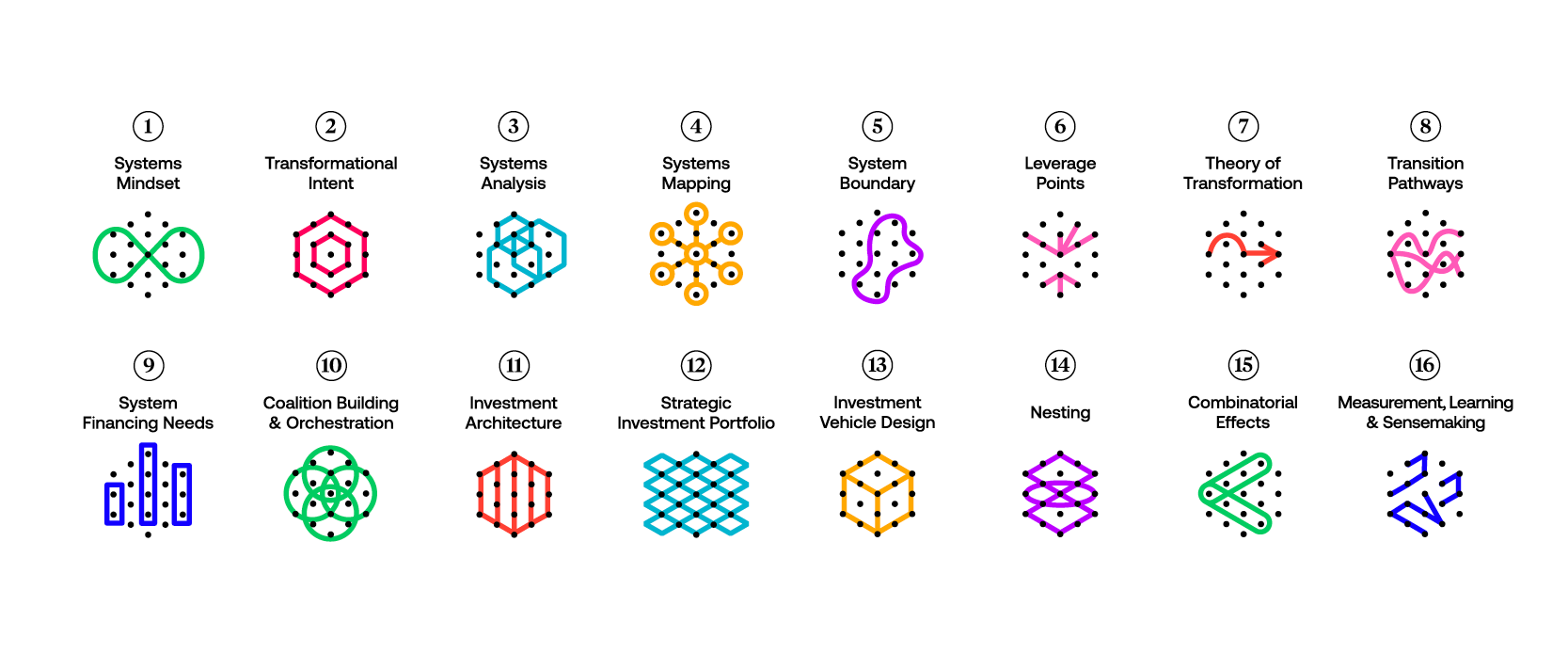

We exist to improve the way sustainable finance is purposed, designed, and managed so that money can become a transformative force in building a low-carbon, climate-resilient, just, and inclusive society. We believe that the key to accomplishing this vision is to inspire and enable investors to leverage the insights and tools of systems thinking and complex systems science for addressing the most pressing societal challenges of the 21st century.

What We Do

Our mission is to build the field of systemic investing. This means developing, testing, and scaling an investment logic at the intersection of systems thinking and finance. We do that by convening a multi-stakeholder alliance to develop a knowledge and innovation base, test novel concepts and approaches, and build a community of practice.

Our core ideas borrow from the disciplines of systems thinking and complex systems science, challenge-led innovation, human-centred design, new economic frameworks, and financial innovation. Our experiments are contextualised in those place-based systems that matter most for human prosperity—such as cities, landscapes, and coastal zones—as well as in value chains and other real-economy systems. We hope that our work produces knowledge and insights, methods and tools, and a self-organising community of inspired and enabled change makers.

The places and value chains we intend to transform act as centres of gravity for our work. In each of these systems, we will work with challenge owners, communities, innovators, investors, and other stakeholders to design, structure, and finance strategic investment portfolios nested within a broader systems intervention approach.