The science is clear, and the world’s top economic authorities agree: To safeguard human civilisation as we know it, we must fundamentally change the way our societies and economies operate.

Our task is to move from an extractive, exclusive, and fragile status quo to a regenerative, equitable, and resilient model that respects the natural boundaries of our planet and honours the social needs of our communities.

This requires that we transform the place-based, socio-technical systems that constitute the bedrock of our current way of life: cities, land use, transportation, energy, industry, infrastructure, and aquatic systems.

Financial capital is one of the most powerful levers for influencing the behaviour of systems and thus plays a critical role in building the low-carbon, climate-resilient, just, and inclusive future envisioned by the UN’s Sustainable Development Goals and stipulated in the Paris Agreement. Policymakers and investors recognise its importance and are increasingly committed to closing the trillion-dollar investment gap that currently inhibits progress towards this vision.

Yet mobilising greater quantities of climate finance is only one part of the challenge. What remains unclear is how, exactly, capital needs to be deployed to catalyse the transformation of place-based systems. What kind of value models, performance metrics, methods, tools, analytical frameworks, partnership structures, mindsets, and sensemaking protocols are required to generate transformative dynamics?

The Transformation Capital white paper sets out to explore these questions.

What seems clear is that the paradigms, structures, and practices of today’s financial sector prevent it from unleashing deep, structural change in the real economy.

Narrow notions of value, outdated world- views, constraining financial mathematics, and a low sense of responsibility over social outcomes drive a wedge between market values and human values. The 2008–2009 financial crisis and the COVID-19 pandemic have demonstrated how easily capital markets are disrupted by events that deviate from business as usual, due in no small part to their rigidity and conservatism. Fortunately, an increasing number of finance professionals realise that climate change and other complex societal challenges pose a tangible threat to their financial assets and thus recognise the need to build a future-proof version of capitalism.

Over the past decade, dozens of sustainable finance initiatives (SFIs) have set out to mobilise climate finance at the trillion-dollar scale, a welcome and important effort. Yet even if they succeed at closing the investment gap, most are still bound to produce incremental outcomes at best in the place-based systems that matter for human prosperity.

The root cause is that many SFIs remain steeped in traditional finance orthodoxy, are vague about the issues they address, and lack a robust theory of change that links their actions to their objectives. They tend to follow a project-by-project mentality — despite empirical evidence making clear that single projects cannot change systems — and are mostly concerned with reducing risk rather than creating value. They often focus on secondary markets and thus operate at a considerable distance from the real economy, which is where the goals stipulated in the Paris Agreement must ultimately materialise.

The consequence is that many SFIs act to preserve the structural fabric of capital markets, making small improvements on a status quo that is incompatible not only with environmental and social sustainability but also with the intent of long-term wealth preservation. And given how fast we must reverse our emissions trajectory and protect our communities from the consequences of a warming planet, the time for incrementalism is over.

What we need now is a radically new approach to investing with the explicit aim of systems transformation — one that deploys capital with a broader intent and mindset; that is anchored in different methodologies, structures, capabilities, and decision-making frameworks; and that moves away from a project-by-project mentality to a strategic blending paradigm.

Transformation Capital is that approach — a holistic investment logic guiding the deployment of capital for the purpose of catalysing sustainability transitions while generating commensurate financial returns. It recognises the world as a complex adaptive system and embeds systems thinking, human-centred design, and sensemaking in all stages of the investment process. It provides the tools and methods to manage the uncertainty, complexity, and ambiguity inherent in socio-technical systems and to engage with social concepts such as resilience, justice, and inclusiveness in an investment context.

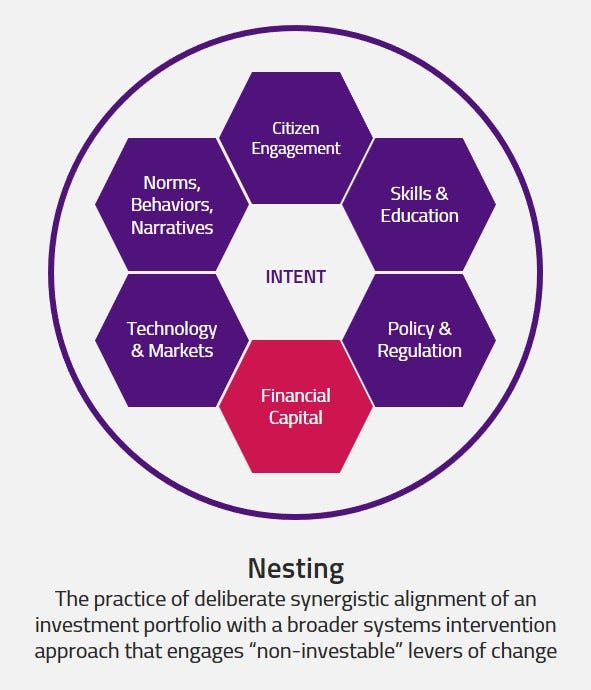

At the core of the Transformation Capital logic sit strategic portfolios — collections of investments deliberately composed and governed to unlock combinatorial effects and nested within a broader system intervention approach.

Based on our long-standing experience in systems innovation, we believe that such strategic blending is the most promising way to unlock transformative dynamics in place-based contexts and address the billion-to-trillion scale challenge of climate finance. Assembling a broad range of innovations into a coherent investment approach, Transformation Capital reimagines notions of value and how value is generated and captured; provides a methodology for how investors can make sense of a system and identify sensitive intervention points; redefines who participates in the investment process and how risks and rewards are shared; and reconceptualises the meaning and measurement of impact.

The Transformation Capital Initiative (TCI) will develop, test, and scale the systemic investment approach and build a pipeline of investment opportunities at the multi-billion-dollar scale. It has an open-ended, multi-stakeholder, and action-oriented structure and borrows methods from human-centred design and systems thinking to build a space for collaborative research, prototyping, field building, and investing. It will thus act as a do-tank for the sustainable finance community and a vehicle for putting a wide range of theories and innovations into practice.

Call to Action

The white paper Transformation Capital — Systemic Investing for Sustainability, published by EIT Climate-KIC, serves as the starting point for what lies ahead — a journey of exploration and discovery, a systematic inquiry of what is possible, probable, and preferable.

We invite challenge owners, systems thinkers, innovation practitioners, investment professionals, ecosystem shapers, and creative voices to join us in figuring out how to deploy financial capital to solve some of the most pressing and tangible problems of our time. If you want to learn more about how to engage with the Transformation Capital Initiative, reach out.