Primer

This is the second entry in a series of articles detailing the TransCap Initiative’s prototyping work around systemic investing in Switzerland. This series invites you along our journey from selecting net-zero mobility as our prototyping mission to eventually producing a set of stakeholder-validated leverage points in January of 2023. These form the foundation for a theory of change and systemic interventions currently under development.

This entry deals with a topic the importance of which we cannot overstate: gaining access to the system we strive to help transform.

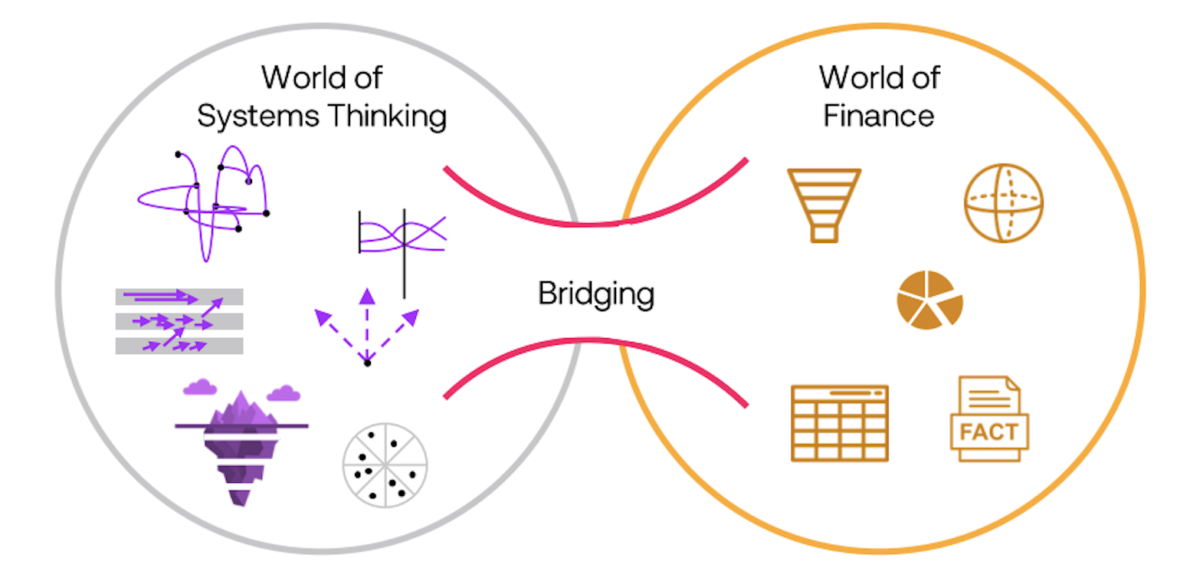

As TCI, our quality lies in building the bridge between the worlds of finance and systems thinking to enable systemic investing. We carry this work out in a variety of different settings and thematic systems, from mobility to sustainable cities and food systems. This focus entails the inherent challenge of system expertise, and by extension system access, not residing with our core team. It instead relies on collaborative approaches, robust partnerships, and shared intelligence.

This entry focuses on:

The need for collaboration & partnerships in systemic investing

Systems access and stakeholder activation

Systems research

Stay tuned for more read-outs on topics ranging from stakeholder activation to system analysis, futuring, sensemaking, and leverage point identification in the coming weeks.

—

Today we discuss the important aspects of our research and stakeholder activation strategy to open and prepare the system for systemic investing activities. You will also find highlights from the lessons we learned while developing frameworks for capturing and analysing knowledge to facilitate iterative thinking in dynamic systems.

Partners Are Everything in Systemic Investing

In order to effectively catalyse transformation within a system through investing practices, it is crucial to carefully map out the real-world dynamics and identify the appropriate leverage points for capital to be dispersed.

Those dynamics are informed by a wide variety of data types from a plethora of different sources. Some qualitative, some quantitative. Some rooted in academic study and industry census, and some rooted in opinion research. Others are purely anecdotal, yet not to be discounted as we are aiming to transform human systems in our work. People's cultural backgrounds, motivations and fears either enable or hinder our progress in a significant way.

Uncovering and productively capturing this diverse set of data is a team effort. In the previous entry to this series, we have spoken about the types of partners we brought into this prototype:

A System Partner

A Finance Partner

A Research & Innovation Partner

We want to take a moment to introduce them to you and explain why this particular constellation matters for systemic investing.

As the visual below illustrates, we aim to build the bridge between the worlds of systems thinking and finance within the context of a given mission-oriented prototype. This work is only possible if the areas to be bridged and the system within which the prototype takes place are supported by a dedicated cast of players as early as possible.

Our System Partner - Swiss eMobility

Swiss eMobility is the main association for the representation of the electromobility sector’s interests in Switzerland. They are acting as a knowledge hub for industry, legislators, and consumers alike, supporting the creation of political and institutional foundations required to develop electromobility in Switzerland. They are a key player in the Swiss electromobility system through extensive sector knowledge, representation in relevant regulatory bodies and leadership of the parliamentary group on electromobility. They are TCI’s long-term strategic system partner and our closest ally regarding system insights and stakeholder access.

Our Finance Partner - EBG Investment Solutions Ltd

EBG Investment Solutions Ltd is an independent, globally active advisor and manager based in Zurich. They invest in sustainable private markets, specifically in private equity, real estate, and infrastructure asset classes. EBG develops and executes customised solutions for institutional investors and family offices to build future-proof, resilient portfolios with sustainability as a key driver of market return and meaningful impact. EBG collaborates with TCI on the design and setup of an investment vehicle, fundraising efforts, as well as both construction and ongoing management of a strategic investment portfolio.

Our Research & Innovation Partner - Metabolic

Metabolic is a systems change agency striving to transition the global economy to a fundamentally sustainable and circular state in which people and nature thrive. They conduct leading research, develop future-facing strategies, build software tools, scale impactful ventures, and empower communities on the ground through systems thinking. Metabolic leverages this expertise to support TCI on the systems analysis process in order to identify key leverage points where capital investment can help tilt the system towards a more sustainable state.

As early as our mission scouting phase, we approached potential partners with a variety of possible collaboration outcomes in mind. Aside from recruiting our chief partners, we looked for and catalogued potential investors and funders, screened for their ability to unlock networks, and provide overall Public Relations opportunities such as events, publications and social media presence.

Systems Research & Stakeholder Activation for Systemic Investing

Prior to deep-diving into data capture (literature review and stakeholder interviews), we chose a research approach in collaboration with our research & innovation partner Metabolic and tailored it to the specific demands of our prototyping work in Switzerland.

The initial approach we chose followed a fairly linear sequence of tasks to be concluded. First of all doing research and gathering a body of data and in a second step translating it into a systems map by teasing out key dynamics and causal loops (our next entry in this series will invite you into the deepest depths of this analysis). In hindsight, we would have run these processes in parallel, with incoming data being immediately mapped in the appropriate tool (Kumu in our case). The reasons for this reflection are many, but there are 3 that stand out in particular:

Moving a vast array of data from one tool to another is a very time consuming process with an inherent risk of key insights surrounding a data point being lost if not placed in the software that serves the ultimate purpose of the data capture (the systems map) from the beginning

Operating within a visual tool that has the power to unearth dynamics within a system from the start comes with a built-in research hygiene check. If the tool stumbles in creating connections and presenting causalities, there may be an issue with the data we feed it. This in turn is a signal for us to revisit our data capture approach (such as the questions we engage system-relevant stakeholders with).

A dynamic visual tool allows us to control for biases. Working with both quantitative and qualitative data bears the risk of us starting to “search for solutions”, as opposed to objectively mapping all relevant components of the system. If the tool generates overly powerful connections that defy reality, it tells us that we may have been biassed in the data we capture and feed into it.

Ahead of commencing our data capture, we also found it a worthwhile exercise to identify and describe the various purposes our captured data must serve, such as:

Inform our understanding of specific elements within the system, such as the uptake and usage of electric vehicles (EVs) in Switzerland

Provide insight into the nature and strength of specific connections, such as “price” being the most important driver for a consumer’s EV purchase decision, as well as other consumer sentiment notions

Unearth contextual information about trends and dynamics within the place-based system, such as existing and developing regulation, active multi-stakeholder alliances, lobby groups, and existing projects towards the same mission goal

Generate foundational understanding of the prevailing visions of the future (convergent or divergent) among key stakeholders, as well as the contemporary measures of success/impact already in place

Reveal key systemic obstacles, related or unrelated to capital, to achieving the net-zero mobility transition

Allow for the high-level discovery of capital flows within the system, isolating those actors and initiatives currently attracting the highest volume of funding, as well as those assumed to be in greatest need of funding

Grant insight into interlinkages with adjacent systems, such as energy, other personal mobility solutions, and post-usage pathways for e-mobility

The Flexible Data Capture Challenge

Obvious as it may seem, choosing and designing the interplay of a series of platforms and software solutions that serve both data capture and analysis early on is of the essence. This is more of a cautionary tale than anything else, truth be told.

Our prototype in Switzerland around Net-zero Mobility and its research agenda kicked into motion while parts of an international, multi-disciplinary hybrid team were still being assembled amidst our think-and-do-tank taking shape. Both incoming crew and the aforementioned varied data types place specific demands on a data capture model in a dynamic system setting. It needs to be flexible, easy-to-adopt, withstand the inherent need for iteration and allow for stakeholder onboarding as well as easy integration with other platforms that will be added as the project evolves. This was a continuous process of trial and error for us as the months went on. If you are seasoned systems folk, we would of course love to hear about how you solve for this challenge and in return wanted to offer out our current (June 2023) tech stack that serves us well (aside from standard fare such as email and virtual meeting platforms):

Notion - Wiki and central brain for everything from ecosystem mapping, editorial planning, project management and file storage, to organisational development and meeting minutes. Also our hub from which we link to other software and files, see below

Miro - Visual space for collaboration (also with partners), remote team-building and culture work, process design, and early knowledge capture/visualisation during system scoping phase

Kumu - Visual representation of systems dynamics, leverage points and causal loops, critical to our system analysis and downstream strategy

Slack - Internal communications and asynchronous insights sharing. Tip: programming a bot in Slack that automatically collects individual inputs from each team member ahead of meetings has been game changing and cut-down organisational drag

Gathering Data & Activating System Stakeholders

We conducted a holistic review of available literature from a variety of sources on the Swiss mobility system, both informing and accompanying 20+ semi-structured interviews we ran in Q3 and Q4 of 2023. Both literature review and interviews were codified using the common set of purposes previously outlined.

Critically, our systems partner Swiss eMobility has played a central role in this phase, further highlighting the need for extreme diligence when selecting any systems partner for future prototypes. Not only did their presence unlock access to many of these stakeholders, their alliance with us further provided the necessary clout and reputational cover to engage other system-relevant stakeholders at eye-level. Their veteran experience in the field coupled with our research approach and data integration capacity culminated in the potent cocktail that would shortly after become our system analysis and sensemaking phase.

The next entry in this series will take you deep into the heart of this analysis phase, rich in system dynamics, feedback loops and interventions we identified to help catalyse the net-zero transition in Switzerland.

Stay tuned for more read-outs from our prototyping work around systemic investing and be sure to follow us on LinkedIn and Twitter.

A Quick Note on Multi-disciplinary Teams

Aside from the variety of purposes our data holds for the systems analysis part of our work, other uses are to be considered in tandem. Eventually, systemic investing is meant to do as the name suggests: invest. While uncovering market dynamics and players in our research phase, we isolated a network of potential investment opportunities along the way. These are currently (June 2023) being matched against those causal loops which hold the greatest number of high-impact leverage points, to be activated by investable (and non-investable) interventions. Another element continuously tracked is the potential for public relations and brand building work. As a relatively new organisation in an emerging niche, part of our implicit remit is to build the field of systemic investing and broadcasting demonstration effects along the various steps of the process. Our prototype and innovation leads, who are driving this research, are therefore accompanied by our leads on investment vehicle design and communications, shortening the timeline of our work seeing the light of day significantly.