We don't know yet what an investment logic capable of transforming place-based and other real economy systems looks like. That's why we will approach the development of transformation capital as an inquiry, a systematic exploration of a set of ideas and hypotheses to discover what is possible, probable, and preferable. The inquiry will borrow methods from human-centred design and systems thinking and follow the method of “deductive tinkering”.

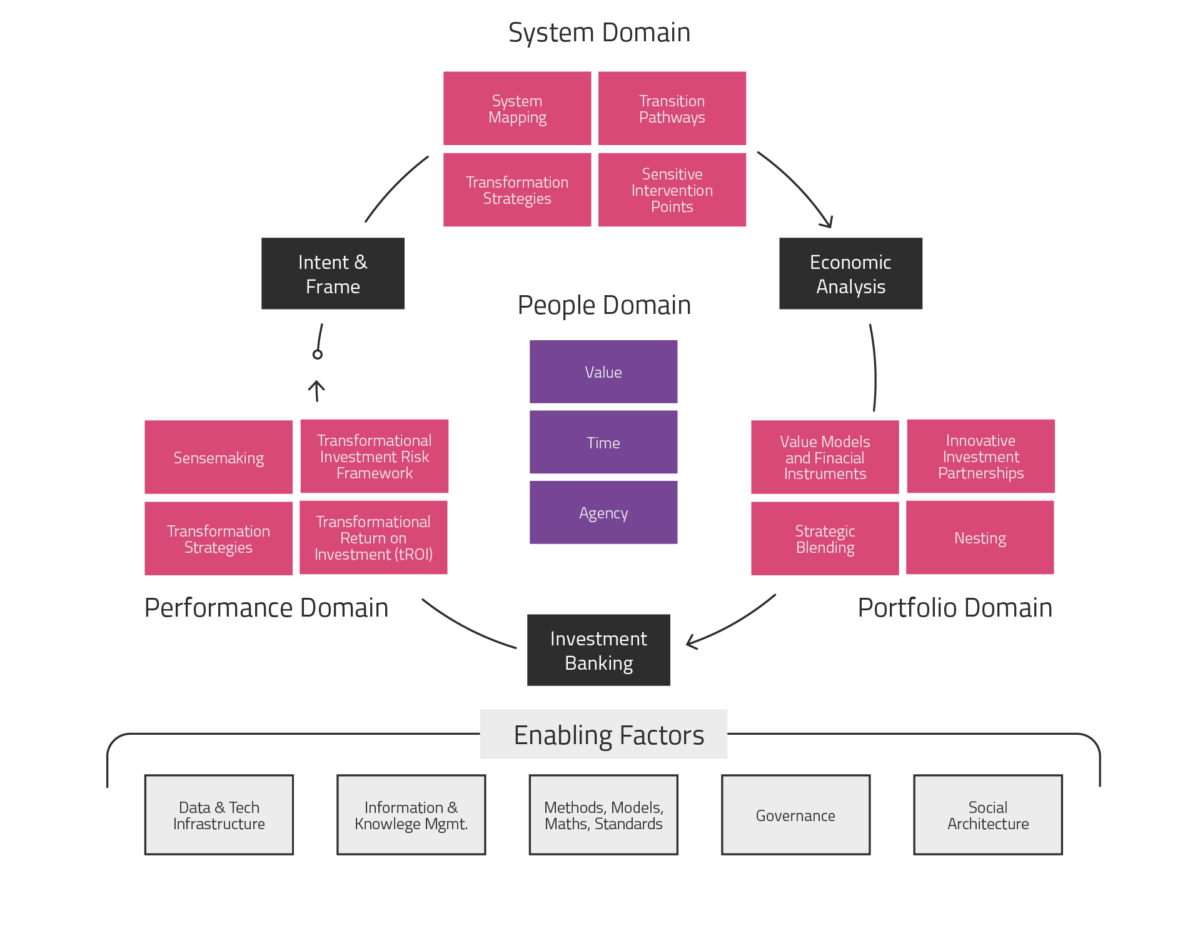

What follows is a set of ideas and hypotheses that establish a coherent starting point, as synthesised into a design space.

People Domain

People are at the core of the design space. This is because the intent-oriented and collaborative nature of systemic investing places certain demands on the mindsets and skills of its practitioners. While there are many people-related elements that are critical, three stand out: people’s notion of value, their relationship with time, and their sense of agency.

In the absence of the right mindset, it will be difficult to escape traditional finance orthodoxy. In its presence, however, much becomes possible. This is why the TransCap Initiative pursues activities aimed at cultivating a productive social space, where these qualities can be developed and practised.

Intent & Frame

The purpose of the Intent & Frame phase is to establish directionality, to scope needs, visions, and objectives for systemic change, and to elicit explicit agreement to work together on a systemic intervention programme. This phase also creates an opportunity to identify and connect existing activities, including those outside the realm of finance. What emerges from these activities is not only a shared consciousness for the desired direction of travel but also a reference point for future learning and sensemaking.

Engaging Challenge Owners

Each TransCap journey starts with convening people who want to bring about change. It is critical to find the right match between individuals, organisations, or consortia and a specific change agenda, as not all actors are equally well-positioned to address a given problem. For many societal issues, there is often a set of people who already have the mandate to act (e.g. by virtue of being elected to office or by having an employment relationship with a government agency or a company) and thus “own” the challenge in the eyes of society. Such challenge owners are particularly powerful anchors of a systemic investment community.

Articulating the Mission

A transformation agenda—articulated as a statement of intent—acts as the compass for systemic investing. It not only sets the directionality of the mission but also activates actors, provides a common vocabulary, and serves as a calibration and negotiation mechanism in case conflicts and trade-offs arise. The way challenge owners frame and define these missions thus matters.

System Domain

The system domain is a space of the analytical and factual, meant to create the knowledge base upon which to structure and implement systemic investment programmes.

Mapping the System

In the context of societal sustainability, transformative change is not just about depth and irreversibility but also about directionality. Human economic activity must transition from its unsustainable status quo to a regenerative and inclusive model. So investors need to make sense of where the system starts from and where it needs to end up, creating useful images of the present and the future, and of the space in between. This means identifying the nodes and relationships within a system and characterising its behaviours and dynamics. It also means getting to grips with a system’s material and financial stocks and flows and with the actors that control these.

Understanding Evolutionary Possibility

System mapping enables the articulation of the transformation agenda in relation to today’s actionable levers of change. In other words, it connects the future with the present, thereby allowing us to construct qualitative and quantitative gap narratives between where the system is at present and where it needs to land in the future. Such a gap analysis is a prerequisite to hypothesising transition pathways. These can be understood as a series of steppingstones—what scientists call "adjacent possibles"—that will move the system closer to its new configuration.

To travel along a transition pathway requires a transformation strategy, a plan for intervening in the system in a way that compels actors to behave as desired. Examples of transformation strategies include de-risking value chains, shifting the relative economics of technologies, redesigning decision architectures, changing the law, establishing new contractual frameworks, influencing values and norms, and accessing uncommon sources of capital.

Leveraging System Dynamics

We know, from both theory and practice, that certain interventions in a system have greater potential than others to cause the system to change. In systems thinking, places of high potency are called leverage points. The key question for systemic investors is this:

Where could a relatively small investment trigger a larger change that becomes irreversible, and where non-linear feedback effects act as amplifiers?

The purpose of considering such sensitive intervention points is to design deliberate interventions that drive nonlinear amplification in complex systems, pushing a system beyond its tipping points through investments in infrastructure projects, technology start-ups, insurance products, public subsidy schemes, and the like.

Portfolio Domain

The portfolio domain is where systemic investors foster collaboration with other investors, deploy capital, and maximise strategic synergies. It's where the rubber hits the road.

Creating New Value Models

Building a low-carbon, climate-resilient, just, and inclusive future requires that we define, generate, capture, and distribute value in new and different ways. Systemic investors can either enhance the value models of existing asset classes or create entirely new asset classes with different structures, rules, and agents. Examples include new digital, social, and institutional infrastructure; markets based on new consumption and production paradigms; and new approaches to corporate governance. These value models can then be made transactable through innovative financial instruments.

One particularly interesting example is the Trees as Infrastructure project led by Dark Matter Labs, which seeks to convert urban forests from liabilities to assets by using innovative, technology-enabled ways of generating, capturing, and distributing the economic and social values created by green infrastructure.

Strategic Blending

In complex adaptive systems, it is rarely a single intervention that unleashes transformational dynamics. Rather, fundamental change is typically the result of multiple forces acting together. Systemic investors can emulate this approach by composing strategic portfolios of assets that mutually reinforce one another.

What matters in constructing such strategic portfolios is not so much an asset’s individual merits but its potential to unlock or accelerate transformational effects in combination with other assets. In other words, the key is to create strategic synergies for producing the right type of change dynamics with respect to the transformation agenda at the aggregate level of the portfolio. This implies a move away from the single-asset approach towards a strategic blending paradigm.

For instance, we believe a city is more likely to see an uptake of electric mobility if investments in charging infrastructure, vehicle availability, new business models (via venture capital provided to start-ups), and innovative insurance products are designed with synergistic alignment as opposed to the isolated way in which this happens today.

Nesting

Where capital alone is insufficient to unleash transformative dynamics, systemic investors should align themselves with actors engaging other levers of change in the system, those that are considered “non-investable” in the traditional sense of capital markets but represent a public good and therefore still require “investment”, such as policy, education, and social capital.

The purpose of such “nesting” is to ensure that the portfolio of real-economy assets is well aligned with a broader set of system interventions, all designed for their collective, synergistic ability to generate transformative dynamics. Such coordination efforts can create market-shaping forces, particularly in the context of public sector missions led by entrepreneurial governments. Mission-aligned investments will arguably enjoy more compelling risk/return characteristics than those made in isolation—a core hypothesis that the TransCap Initiative will seek to test and validate.

For instance, the spectacular rise of electric mobility in Norway is the result of smart policy changes designed in strategic alignment with private-sector action.

Investment Partnerships

Systemic investing is inherently collaborative. It creates the opportunity to form innovative investment partnerships, particularly between governments and non-governmental asset owners. TransCap aspires to rethink who participates in funding system transformations. In particular, it strives to reimagine the role of citizens and communities along all stages of the investment process.

Irrespective of the specific composition of an investment partnership, strategic portfolios can be structured in multiple ways. One approach is to package them as a fund-of-funds vehicle in which the underlying instruments share a common impact mission. Another is to establish special purpose vehicles designed and approved for multi-asset-class holdings. A third is to construct portfolios virtually, i.e. not consolidate them in a single legal entity but instead superimpose a coordination mechanism that aligns them.

Performance Domain

The performance domain is where systemic investors measure the effectiveness of their interventions and take corrective action if necessary. Specifically, they need to make sense of what emerges in the system they intend to change, evaluate different types of returns on their investments, and manage risk.

Sensemaking

As the effects from investments and other interventions take hold, the system starts to react. Systemic investors need to be proficient at observing change in a system and at making sense of any new patterns and behaviours that emerge. There is a method for studying systems-level change in a systematic and rigorous way: sensemaking.

Sensemaking is a collaborative activity that taps into the collective intelligence of groups and produces intelligence and insights about how systemic interventions can catalyse transformations. It provides a window into potential futures, allowing investors and other agents of change in the system to understand what is possible, probable, and preferable. The goal is to identify where to amplify effort, increase investment, or combine solutions for accelerating and intensifying change.

Measuring Transition Dynamics as Impact

Systemic investors are interested in a broader range of outcomes than traditional investors, who tend to focus on financial returns only. So their conception of risk and return is broader, too. Importantly, they care most about the value they generate—and the risks they need to manage—at the level of the system rather than at that of individual assets.

Quantitative indicators, such as those related to CO2 emissions so prevalent in traditional investing, are often ineffective metrics for assessing system-level outcomes. Not only do they suffer from a myriad of measurement and attribution challenges, but they also lead to preferences for action in domains with neat boundaries and short causal chains, such as the energy system. In more complex systems—transportation, forestry, coastal zones, industrial supply chains, and cities—outcomes can rarely be attributed directly to a single intervention or be expressed in a quantitative metric. In addition, outcome objectives often go beyond emissions reductions and include harder-to-measure results such as resilience, justice, and inclusiveness.

This is why systemic investing requires a new set of indicators, anchored in an understanding of the transition dynamics that show whether a system is evolving in the desired direction. This will then allow us to compute a new type of success metric—transformational return on investment (tROI)—and open the door to developing a different conception of risk, one more suited for systemic, mission-oriented investing happening in the context of fundamental uncertainty.

Enabling Factors

The enabling factors are the glue that holds the different domains together. They establish the foundations to operationalise the TransCap approach, promote capacity building, scale the investment logic, and prevent mission drift.

The most important enabling factors include:

- Data & Technology Infrastructure: the frameworks and protocols needed to collect, store, and process the data that informs and drives systemic investing.

- Information & Knowledge Management: a carefully designed sensemaking and learning infrastructure combined with state-of-the-art knowledge management technology to generate intelligence and make it actionable.

- Methods, Models, Mathematics, Standards: codify learnings to enable consistent repetition across contexts and form the basis for training programmes, standards development, and certification schemes.

- Governance: an effective framework to create the freedom to operate while providing guardrails and decision-making guidance to deal with questions of ethics, to avoid mission drift, mission retreat, and unintended consequences, and to keep in check the unproductive biases, heuristics, and default dynamics of social systems.

- Social Architecture: create vibrant spaces in both the physical and virtual world that create the fertile ground for innovative pursuits: dense diversity, dynamic and open exchanges, creativity, serendipity, experimentation, and learning.