Over the past couple of months, the TCI team in Zurich has been working tirelessly towards a critical moment in our exploration of a systemic investing logic that has the power to help speed up the transformation of the Swiss mobility system to one more low-carbon, inclusive and social:

An 18 party workshop, comprised of leading mobility system experts from academia, finance, politics, and industry, designed to validate and fill in a set of potentially systems transforming leverage points in the electromobility arena.

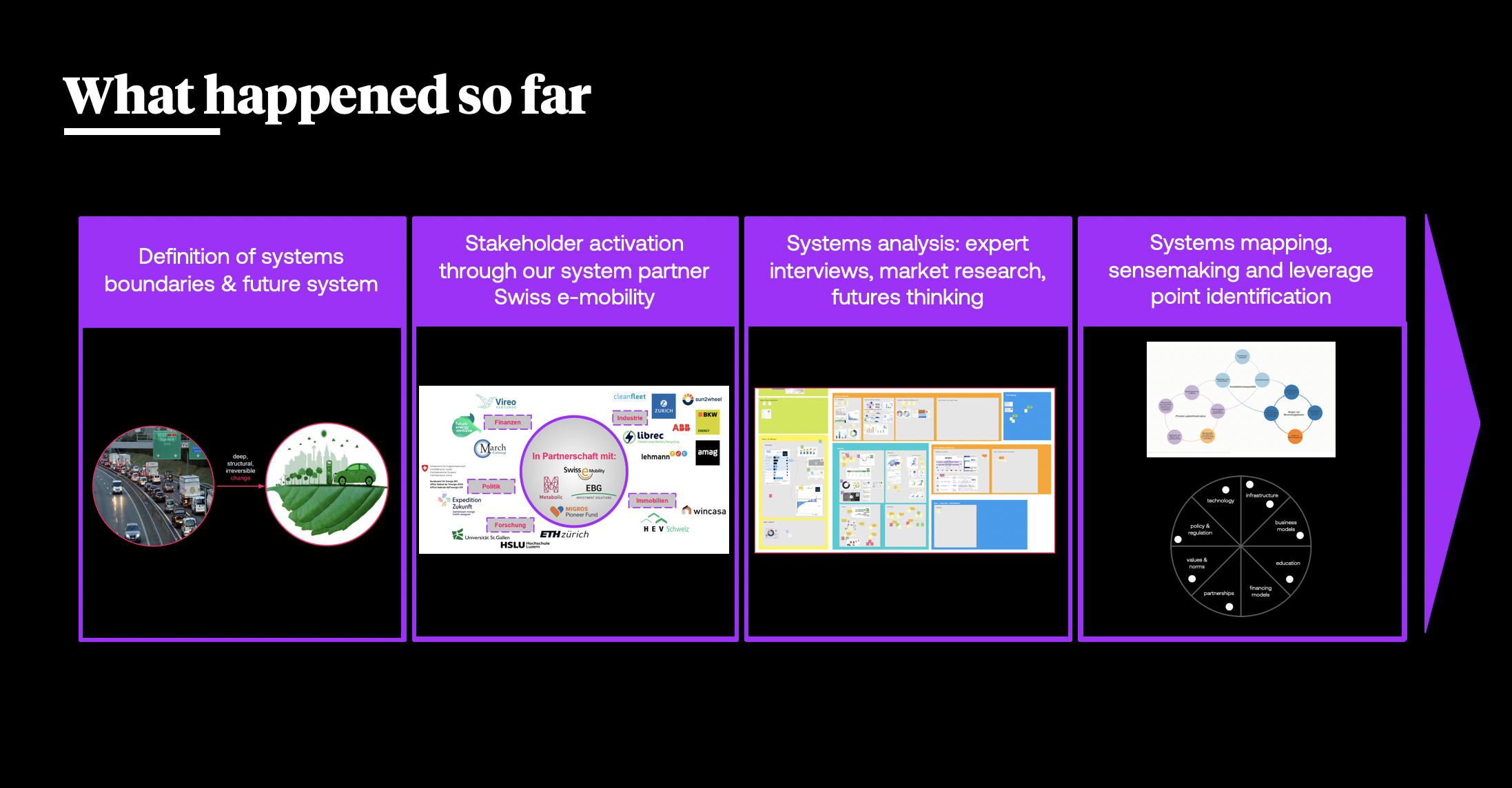

How did we get here? Like so:

[If, before you proceed, a refresher on our priming ambition and approach for the Swiss mobility landscape would be useful to you, feel free to pop over to this article]

Systems Mapping, Leverage Points and Causal Loops

The below slide outlines the overall sequence of events between September 2022 and our workshop in January of 2023.

What you see presented as a linear process is anything but linear, nor can we do the in- and outputs of each step justice in a short paragraph. Every step of the way required numerous iterations and reassessment of toolkits that are fit-for-purpose for this kind of work. We strive to be an organisation that is centred around open innovation concepts as we endeavour to build a community of practice in the emerging world of systemic investing. In the coming weeks, we will share a series of short-form articles that will invite you deeper into our process, the u-turns we made and insights we gathered in areas such as research design, systems mapping and sensemaking methodologies.

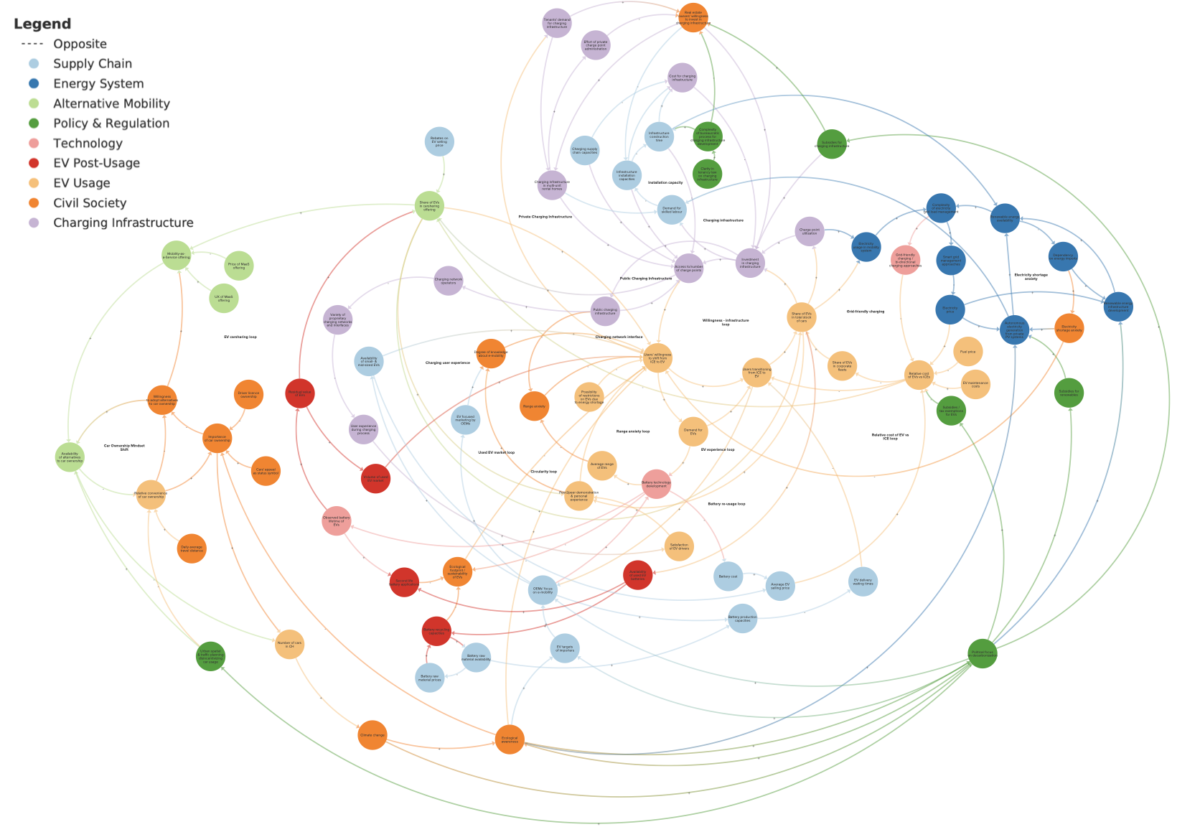

The critical climax of this work is a depiction of the Swiss mobility system in the form of a systems map, a web of elements and connections forming causal loops that represent fundamental dynamics of the system. Analysing this map allowed us to identify strategic leverage points, which we understand to be “places within a complex system where a small shift in one thing can produce big changes in everything else”.

The below image is our map in its totality. We don’t recommend that you attempt to zoom in and decipher it. We are sharing it simply to give you a sense of scale and complexity, a sense and appreciation that is critical for anyone wanting to anticipate and follow the development of interconnected interventions to move the system towards greater sustainability.

Sidenote: We used the software Kumu to, in their words, “make sense of a messy world”. We have our thoughts on its efficacy, but will share those in our micro-article series.

This diagram formed the basis of our stakeholder workshop. Before we dive into what transpired, we do want to point your attention to the legend in the top left corner. At the TCI, we speak of the field of systemic investing. As the name suggests, the flow of capital is the active agent of change this field concerns itself with. However, capital flows not nested within enabling structures in civil society, policy and regulation will not move the needle. A central pillar of our work revolves around mapping interdependencies between those interventions that can be driven by capital investment, and those that create the societal context within which they operate.

Bringing Stakeholders to the Table

We brought this group of people together in order to validate and gap-analyse the pre-defined leverage points and develop first ideas for potential interventions:

We aimed to create a set of tangible, effective and feasible interventions with which to activate leverage points in a real-market setting, and will continue this work in the upcoming weeks/months.

Besides this main goal, the workshop served a multitude of purposes. We will focus on one in particular in the following paragraphs, but as open innovation advocates feel compelled to share the full set as a peek behind the curtain:

Involving stakeholders relevant to your targeted system interventions into working sessions helps build the field and creates the level of cross-sector connections necessary for systemic investing work.

It allows you to check your biases that will inevitably build up during analysis work you do in-house.

Our expertise lies in mapping possible leverage points and identifying interventions to activate them. Involving system-relevant stakeholders into the conversation from an early stage provides for a faculty that reality checks, gap analyses and prioritises the wide array of options along both impact and feasibility axes.

For this workshop, we decided to pit 4 causal loops from our overall analysis against the stakeholder expertise present in the virtual room. These 4 loops were selected for their high connectedness with elements all over our map, thus indicating their importance for the general behaviour and evolution of the entire system. The 4 loops can be described as follows:

Private Charging Infrastructure & Electricity Generation

This loop depicts questions of accessibility to private charging points, lacking installation capacity and user’s fear of electricity shortages when considering electric vehicles (EV).

Public Charging Infrastructure & Smart Charging

This loop depicts questions of accessibility to public charging points as a deciding factor to EV ownership, as well as the role of smart uni- or bi-directional charging as a stabiliser for the electricity grid and monetisation incentive for EV owners.

Circular Economy and Battery Technologies

This loop depicts questions about EV second hand markets and circular economy with regards to battery re- and upcycling.

Car Ownership and Carsharing

This loop depicts questions of how society values personal car ownership culturally, as well as mobility-as-a-Service solutions.

In a first step, we challenged our stakeholders to in turn challenge the integrity of the loop itself. While desk study and interviews with some of the people in the room had produced them over the past 5 months, it was of pivotal importance for us to test their validity and fill in blind spots that either research oversight or biases during our analysis process may have produced. In a second step, we focused the group’s efforts on selecting those leverage points for further analysis which to their minds bore the greatest potential to transform the system in question through targeted interventions, activated through systemic investing.

The bulk of our work together was then centred around collecting, analysing (for potential impact and feasibility) and prioritising both existing and missing interventions to activate said leverage points. Our workshop participants not only assembled and assessed these interventions, but were also asked to do a series of scenario projections so as to inspect them through a systems lens. What could be undesirable consequences? Who would be affected, were they activated? What risks are intrinsically attached to the selected interventions? Whom would it take to action them, what is the right web of enabling partners?

A full report of our findings is in the works and will be shared publicly in the coming weeks. Yet, we wouldn’t just conclude this report without at least a few cliff-hangers:

Granting access to private charging infrastructure remains one of the prime challenges to electrify the Swiss mobility system. All-in-one “from-roof-to-cellar” private market solutions may prove to be a gamechanger for e-mobility and renewable energy generation alike.

While many of the existing gaps in the charging infrastructure landscape will be addressed through commercial investors, innovative approaches to public-private-partnerships will be essential to address public charging infrastructure gaps in particular.

The volume and vitality of the second-hand car market is key for the widespread uptake of electric vehicles and innovative approaches at the hands of established insurance players could play a big role.

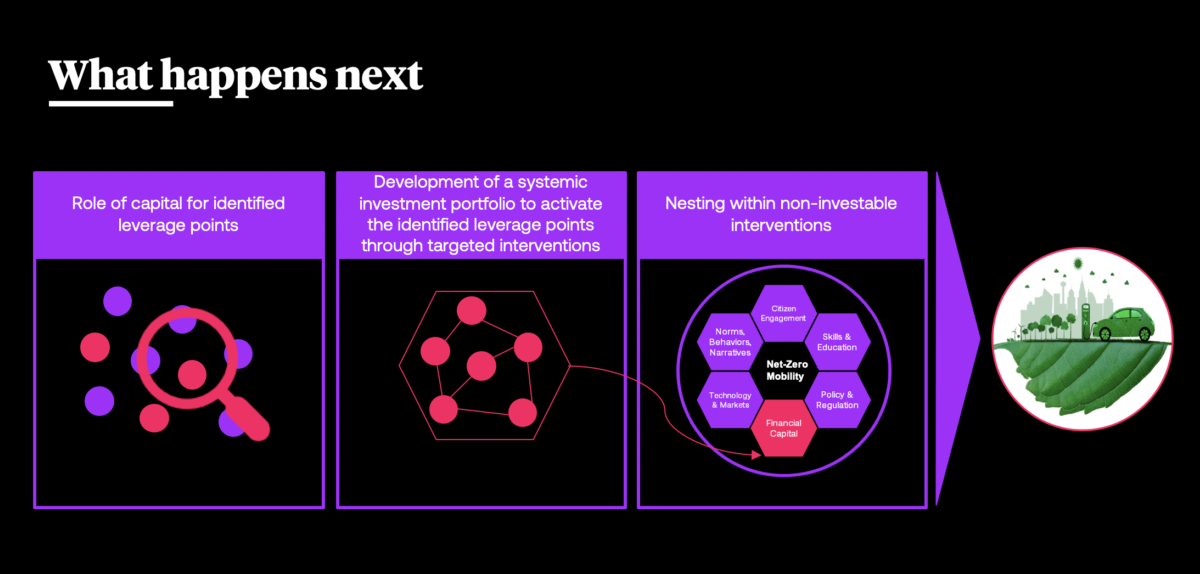

An Intervention Universe for Systemic Investing

Over the coming weeks and months, our team in Zurich will continue to unpack our learnings, on both system and systemic investing methodologies and theory of change, and share them with you on this platform and through our LinkedIn page.

Meanwhile, we are slowly starting to open the chapter in which things move from the drawing board towards implementation. A chapter in which we will build the bridge between systems analysis and the creation of an investment portfolio which, nested within non-investable interventions, has the ability to drive real change in a real-economy setting.

Get Involved!

To stay abreast of our progress on this prototype and others, follow the TransCap Initiative on LinkedIn!

If you wish to get involved in this space, get in touch via community@transformation.capital and continue reading about the ideas fuelling the TransCap Initiative here.